Looking for a smart way to diversify your assets? Investment in cars can be a profitable and exciting opportunity if you know what to look for. From rare vintage classics and limited-edition luxury models to high-demand modern vehicles, the car market offers unique investment potential. In this comprehensive guide, we explore everything you need to know about car investments, including appreciation trends, types of vehicles worth investing in, risk factors, real-world examples, and expert tips. Whether you’re an experienced investor or just starting out, learn how the right investment in cars can deliver high returns and long-term value.

The Investment in Cars Is It Worth It?

When approached with knowledge and strategy, cars can be a lucrative investment Vehicle depreciation is a fact of life. In general, the value of a car depreciates over time. But there are certain models that buck that trend. Classic cars, luxury automobiles and limited edition specials can all be justifiably described as appreciating assets, since they have shown huge gains in value. This article attempts to illustrate how investment in cars can make sense financially; from which car type offers the greatest rewards to what problems it faces and solutions for them.

This paper will consider what approaches we might take given these difficulties and opportunities.Experian Credit Report

How Your Car Depreciates and Appreciates

Depreciation: How the Mighty Fall

New cars tend to depreciate quickly. The average car can drop up to 20% in value during its first year and 15% each year for the following four or five years. Roughly five years later, the vehicle is usually worth a little more than half its original selling price. Finance Planning+1Homepage – Accountend+1Experian Credit Report

Appreciation: The Exception to the Rule

But there are some cars that don’t follow this pattern. Classic cars, limited runs and some luxury models can gain value. For example, a Ferrari 250 GTO was sold for $48.4 million in 2018, with show the potential for high yields in the classic car market. Wealth Formula+1The Australian+1

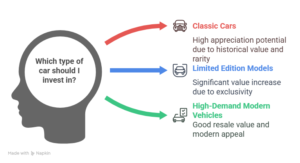

Types of Cars That Make Good Investments

Classic Cars

VINTAGE CARS Vintage cars, particularly models with historical provenance, rarity and unique characteristics, have been a valuable investment. Cars such as the Porsche 911 and Ferrari 250 GTO have grown significantly in value.

Limited Edition Models

Vehicles made in limited runs are typically collector’s items. One such car is the Ferrari LA Ferrari, limited to 499 cars, which rebounded from $1.4m to over $3m in just a few years.

High-Demand Modern Vehicles

Some later model vehicles, such as the Honda Civic in Pakistan, have higher than average resale values. You get to keep a Cilantros, worthy of 37 lacs when released, after years of use, now available is over 1 crore on the market, a whooping 175% in 4 years.

Factors Impacting the Value of Invest in a Car

A number of factors can affect the investment value of a car:

- Brand Value: Brands such as Ferrari, Porsche and Mercedes-Benz have a reputation for maintaining or appreciating in value. Financial Times+11Wealthy Byte+11Wealth Formula+11

- Condition and Maintenance: Vehicles in good condition with low mileage tend to appreciate.

- Rarity/Demand: Signed, special, unique, limited production version models are worth more.

- Historical Value: Cars with a history or close ties to a certain event or person can have greater value.

Risks Associated with Car Investments

Sure, cars can be great investments, but it’s important to understand the risks involved:

- Expensive Maintenance: Vintage and luxury cars can be costly to maintain.

- Volatility in the Marketplace: The value of cars can change due to market ebbs and flows and the economy.

- Storage and Insurance: Keeping a car in a way that retains its value is a must, and another expense you must factor in. National Times+12Investopedia+12Finance Planning+12

Depreciation: Not every car appreciates; in fact, many lose value over time.

How to be Smart in a Car Investment

To get the biggest bang for your car-investing buck:

- Do your homework, thoroughly: Know the market you are buying into, which models are in demand.

- Choose Carefully: Stick with cars that appreciate and have a respected brand. Wealthy Byte+1Investopedia+1

- Take Good Care of the Vehicle: Putting regular maintenance and storage back into your car to maintain or increase its value.

- Expert Consult: Consult with experts in automotive investment to ensure that you’re making the right choice.

Investment in Cars in America

Classic and luxury car investment is more established in the USA than the UK focused and collectable car investment market. This stands in stark contrast to emerging markets where supply constraints are enough to send even the most basic of sedans rocketing in value; the American market, however, is more and more an all too predictable story of rewarding cars with a history, a brand, and a short production run.

The following is a list of various cars in the United States that have seen significant appreciation from 2020 through 2024:

| Car Model | Purchase Price (2020) | Current Value (2024) | Appreciation (%) |

|---|---|---|---|

| 2012 Porsche 911 Carrera | $45,000 | $68,000 | 51% |

| 2005 Ford GT | $150,000 | $425,000 | 183% |

| 1994 Toyota Supra Turbo | $60,000 | $130,000 | 117% |

These vehicles were chosen based on rarity, condition, and collector interest. For instance, the 2005 Ford GT, which had a limited production run, is now considered a modern classic and has seen its value nearly triple.

This American case study shows that investment in cars can be lucrative, particularly when focusing on niche models with passionate buyer communities.

FAQs About Investment in Cars

Q1: Is buying any car always a good investment?

A1: It’s not true, in fact most cars go down in value Negotiate but not too much: Many consumers spend hours trying to negotiate a few dollars off the price of their new car, but experts say that small of savings might not be worth the time and effort. On the other hand, some classic or rare modern cars can increase in value. Wealthy Byte

Q2: How do I know whether a car will appreciate?

A2: Study the car and find the corresponding brand reputation, production, history, demand, etc.

Q3: How much does it cost to own an investment car?

A3: Expensive to maintain, store, insure and if you need to restore it to the original condition. Investopedia

Q4: Can I sell my investment car at any time?

A4: You can sell at any time, would depend on market conditions.

Q5: Are new or used cars better for investing?

How about second hand? Q5: Second hand cars can sometimes be a better investment opportunity, particularly classics and limited edition models that are rare and have some history behind them.