Discover what you can use a mortgage for home equity helps homeowners to unlock their properties’ value, without adding the amount of debt. Know the benefits, procedure as well as comparisons in this thorough overview.

Introduction: What is a Home Equity Investment Loan?

The mortgage for home equity is a type of financial product which allows homeowners access to the equity in their home without having to borrow money. In contrast to traditional loans, this type of loan offers a lump-sum of money in exchange in exchange for a share of the future value your home will gain. In essence, you’re trading part of your home’s potential value rather than taking out funds that require monthly payments or an interest rate.

This unusual arrangement could be ideal for those looking to increase your home’s equity, but also want to steer clear of high-interest loans as well as the pressure of having to make monthly payments. In this post we’ll go into greater detail about the way the mortgage for home equity operates, what its advantages are and drawbacks, as well as the way it compares to conventional loans.

How Does a Home Equity Investment Loan Work?

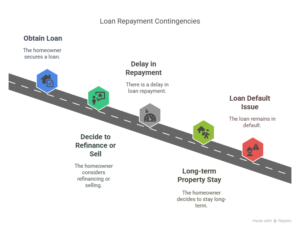

Simply put, an mortgage for home equity permits homeowners to get gain access to cash to share the property’s future value. Contrary to home equity loans or loans, this type of arrangement isn’t dependent on regular installments or the payment of interest. The repayment instead is contingent on the purchase or refinancing of your home.

This is how it will work:

- Assessment of the Home’s Value A lender or an investor assesses the value of your home’s present value.

- offer of money For an equal share of the property’s growth in the future, an investor will give you a lump-sum of money.

- Repayment upon Refinancing or Sale: If you decide to sell your house or refinance your loan, the investor is paid some of the growth in value of your property in accordance with the agreement you signed.

The main difference that separates this from conventional loans is the fact that there aren’t regular monthly payments, and there is no fees are charged over the duration of the loan.

Advantages of a Home Equity Investment Loan

Selecting the mortgage for home equity provides many benefits specifically homeowners looking to have access to their equity from their home without increasing the burden of debt. We’ll look at these benefits:

1. No Monthly Payments

One of the best benefits of one of the most appealing features of a mortgage that invests in home equity is the fact that it does not need monthly installments. The traditional loans, such as home equity loans, also known as HELOCs typically have the obligation to pay monthly. When you get a home equity loan, you do not have to be concerned about regular payment, which could help alleviate financial strain.

2. No Interest Charges

Contrary to conventional loans, which typically have interest costs however, unlike traditional loans, which typically have interest charges, a house equity investment loan doesn’t accrue an interest charge over time. This means it’s a affordable and predictable option because you will not be burdened by high interest charges.

3. Flexible Repayment Terms

As repayment is only due after you refinance or sell your property A investment loan for your home equity gives you more flexibility compared to traditional loans. You can stay at home in the comfort of your own residence and be patient before paying back the loan.

4. No Credit Score Requirements

A further advantage is that homeowner equity loans do not require a good credit score to qualify. This is a feasible alternative for homeowners who might not be eligible for conventional loan due to credit problems.

5. Access to Cash Without Selling Your Home

A lot of homeowners have financial issues but aren’t ready to put their houses on the market. An mortgage for home equity can allow you to draw value from your house without having to place it up for sale. Cash can be accessed to invest in renovations, investment, or for debt consolidation, without having to worry about selling.

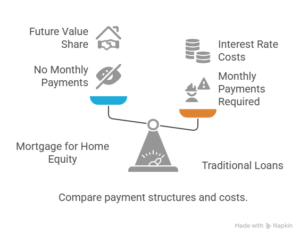

Comparing Home Equity Investment Loans to Traditional Home Equity Options

It’s crucial to comprehend the way the mortgage for home equity contrasts with other options for home equity including conventional home equity loans as well as line of credit for home equity (HELOCs). Below is a chart to illustrate the difference:

| Feature | Home Equity Investment Loan | Home Equity Loan / HELOC |

|---|---|---|

| Monthly Payments | Paying no monthly fees | Payments on a monthly basis are required |

| Interest Charges | No interest charges | The interest rates are in effect |

| Credit Score Requirements | No credit score is required. | There are requirements to score credit |

| Repayment Terms | Repayment on sale or refinance | Fixed repayment schedule |

| Risk to Homeowner | Low risk, no debt obligations | Monthly payments, higher risk |

| Flexibility | Flexible repayment schedule | Set payments, less flexible |

Based on this analysis is clear that home equity investment loans are more flexible and mortgage for home equity provides greater flexibility and less financial commitments in comparison to conventional loans, which makes it more affordable for numerous homeowners.

How to Qualify for a Home Equity Investment Loan

To qualify for the mortgage to invest in your home is pretty straightforward and usually involves less paperwork than conventional loans. The typical process to be eligible:

- Home Appraisal The lender assesses the current value of your house by conducting an appraisal.

- Eligibility Test: While a credit score isn’t a significant element, some lenders could nevertheless conduct a credit assessment to gauge the financial strength of your client.

- The terms of the agreement: Once your home is appraised, a lender will offer you an offer of cash based on the percentage of your house’s potential value. The terms of the agreement will outline your repayment if you decide to either sell or refinance.

- Receiving Funds After the contract is completed, you will be able to receive the lump sum in cash.

The process can be more efficient and simpler in comparison to obtaining the home equity mortgage or loan.

Potential Risks to Consider

Even though the mortgage for home equity provides many benefits but there are some dangers to be aware of:

1. Loss of Future Property Value

One of the biggest drawbacks is the fact that you’re committing to surrender a portion of the future value of your house. If the value of your home increases significantly it will be required to pay an even larger share of earnings when you sell.

2. Long-Term Commitment

The loan repayment is contingent on the refinancing or sale of the home you live in, so there could be a lengthy period before you repay the loan. If you choose to remain on your property for the long term the home could be an issue because the loan is still in default.

3. Limited Control Over Future Decisions

In certain instances there are instances where investors decide what you do with or how to sell your home, subject to the conditions of the agreement. This can affect your flexibility in making any your future decisions regarding real estate.

FAQs About Home Equity Investment Loans

1. What amount can I get from a home equity loan?

The amount that you can take out is contingent on the worth of your house. In general, you are able to borrow as much as 20%- 30 percentage of your house’s worth.

2. Do I require a good credit score to get a loan?

The answer is no, the mortgage for home equity usually doesn’t come with the strictest requirements for credit scores which makes it more affordable to homeowners who have less than perfect credit.

3. What happens if my home declines in its value?

If the value of your home decreases then the debt owed to investors will decrease. There is no obligation greater than the property’s worth that is a safety secure net.

4. What can I do to repay the credit?

When you repay the loan, you decide to sell or refinance the home you live in. No monthly payment or charges for interest to fret about.

5. There are any charges for the home equity investment loan?

Certain fees could apply like closing costs or appraisals for homes However, these costs generally are lower than the ones that are associated with conventional mortgages for home equity.

Conclusion: Is a Home Equity Investment Loan Right for You?

An mortgage based on home equity could be a good option for those who require access to funds but do not need to carry on any additional debts or go through the burden of monthly installments. The loan offers flexibility, lower cost of borrowing, as well as a more straightforward application process than conventional loans.

Prior to making a decision, take a look at your future goals, and whether you’re willing to share a part of your house’s value in the near future. If this strategy is compatible with your goals this could prove to be an effective method to increase the value of your house’s equity.

External Links: you can get more info